How It Works

What is Equity Crowdfunding?

Equity crowdfunding (ECF) gives investors access to a list of businesses looking for funding in exchange for their shares. You as an investor will pick the business that you believe have the potential to grow. You will then have a slice at the returns of a business when it succeeds, although bearing in mind that if the business fails, you may lose your investment.

What are the potential returns of investing on equity crowdfunding?

Participating in equity crowdfunding means that you are part of a revolution of the investment sector. Equity crowdfunding is still new in Malaysia and successful exits can take anywhere from 3 to 10 years. Having said that, it is the nature of equity crowdfunding that it attracts both high potential businesses as well as intrepid-and-willing-to-fund investors eager to diversify their investment portfolios. Returns on the business funded are therefore commonly larger than conventional investment instruments, with most investors looking to double their investment in 3-4 years. Apart from monetary returns, investing in businesses through crowdfunding has its charm compared to say, investing in a list of anonymous portfolios from a large-cap company or publicly traded companies. This is because you could choose which type of businesses or ideas to focus on and invest in which they may be in line with your passion or desires. Take for example, an investor who is an enthusiast in health may invest in a pitch that promotes health related products

How risky is investing in equity crowdfunding?

As in all investments, there are always risks involved. It is key that all stakeholders play a role in mitigating the risk factor(s), and that includes you as the investor, the entrepreneur, as well as the equity crowdfunding operator i.e. ATA PLUS.

The businesses listed on ATA PLUS include start-ups or rapidly growing ventures. Investment in these types of businesses can be speculative and carries high risks. You may lose your entire investment and must be in a position to bear this risk without undue hardship. A rule of thumb for all potential investors; investments made through equity crowdfunding should be in the effort to diversify one’s portfolio and to spread risks. Investors are highly advised to acquire as much information on the business they want to invest in order to derive an informed investment decision to carry on independent and individual due diligence.

Ask questions, read all information given carefully, and seek independent financial advice before committing yourself to any investment.

What protections are there from the risk of investing?

While risk can never be eliminated, ATA PLUS aims to identify risks to investors and help to reduce risk where possible. We have embedded key risk management strategies within our screening process to mitigate the associated risks, such as fraud and ensure the listing of quality deals (distinct product/services, high potential returns, sustainable business model, experienced management team with good track record).

- ATA PLUS reduces the risk of fraud through checking, against publicly available information, the identity of the company and information provided by the company relating to the identity and character of its directors and senior managers.

- We exclude any company from being listed if we are not satisfied as to the identity of the company or of the company’s directors and senior managers, if we have reason to believe that any of the company’s directors or senior managers are not of good character, or if we have reason to believe that the company is not likely to comply with the obligations imposed on it under the service ATA PLUS provides.

- We will exclude any company from our services that engages in conduct that is misleading or deceptive, or likely to mislead or deceive.

All businesses that intend to raise financing through ATA PLUS have to undergo a 2-level screening process.

Businesses MUST pass our Level 1 and Level 2 screening to be listed on the ATA PLUS portal.

ATA PLUS facilitates investors in obtaining clear and concise information to help them to decide whether to invest. In addition, investors can also ask entrepreneurs directly to clarify or provide additional information through the online forum available on ATA PLUS.

Investors have protections through company law and securities law. Investors also have additional and well-defined protection through a shareholder agreement relating to each business they invest in.

Having said that, additional risks for investors to consider before investing may include uncertainty of returns, lack of liquidity, dilution, materiel events and/or shareholder lack of control which is disclosed in our Risk Warning Statement.

A rule of thumb for all potential investors; investments made through equity crowdfunding should be in the effort to diversify one’s portfolio and to spread risks. Investors are highly advised to acquire as much information on the business they want to invest in order to derive an informed investment decision to carry on independent and individual due diligence.

- Level 1 screening looks into the the credit-worthiness of the business and the key management team (CTOS, CCRIS, DCHEQS). This reduces the risk of fraud. . ATA PLUS will exclude any company that engages in conduct that is misleading or deceptive, or likely to mislead or deceive.

- Level 2 screening focuses on the key products/services of the business, the USP, the business model, how much funds the business is trying to raise and will used for what purpose; and the potential gains and exit strategy for the investor.

Investing Guidelines & Eligibility

How do I register as an investor?

You can register as an investor immediately upon the sign up process. You can continue browsing deals and register as an investor in detail once you’ve decided to invest. You will then need to provide us with your personal details for us to conduct a KYC (Know-Your-Customer) to verify your identity to ensure all investors are who they claim to be.

Am I eligible to invest?

Everyone is eligible to invest. You will however be classified to different categories of investors according to your investing limits, as per the Securities Commission guidelines described above. There are 3 types of investor categories:

- Sophisticated Investor: High Net Worth Individual i.e. an individual with a total wealth or net personal assets exceeding RM 3 million or its equivalent in foreign currencies OR High Net Worth Entities (Companies/Corporations) i.e. corporation with total net assets exceeding RM 10 million or its equivalent in foreign currencies based on the last audited accounts

- Angel Investor: An investor that is a tax resident in Malaysia whose total net personal assets exceed RM3 million or gross total annual income is not less than RM180,000 or its equivalent in foreign currencies in the preceding twelve months or jointly with his or her spouse, has a gross total annual income exceeding RM250,000 or its equivalent in foreign currencies in the preceding 12 months

- Retail Investor: An investor that does not fall under the categories of either Sophisticated or Angel investor

How much can I invest?

As an investor, you are subject to the investment limits provided in clause 11.21 of the Guidelines on Regulation of Markets under Section 34 of the Capital Markets and Services Act 2007, as follows :

- Sophisticated Investor: no restrictions

- Angel Investor: a maximum of RM 500,000 within a 12-month period

- Retail Investor: a maximum of RM 5,000 per issuer (Entrepreneur/Deal) with a total amount of not more than RM 50,000 within a 12-month period

It is highly recommended that you diversify your investment portfolio across a spread of portfolio of investments and asset classes, to minimise your investment risks. Also, importantly, avoid investing any more than you are able to lose.

Understanding the Process

How does the investing process go?

As soon as you register as a member, you can start browsing the business listing offered by entrepreneurs under ‘Discover Deals’ section. Once you’ve identified a business proposition that interests you, you may engage with the entrepreneurs to satisfy your own investment needs. Typically, investors will:

- Assess deal: Evaluate the business's value proposition and inspect the proposed financial projection(s).

- Further Enquiries: You may want to enquire for more information from the entrepreneur to make an informed investment decision. You can do this by joining the Closed-User-Group (CUG) Listing Online Forum as well as observing online discussion between potential investors and the entrepreneur on the equity offering.

- Commit amount to invest: You can commit an amount to invest in the business by clicking on the ‘INVEST’ button. This will prompt for you to complete your personal information and declare your capacity to invest (see investor eligibility: Sophisticated/Angel/Retail). Agree with the proposed Investment Agreement set between you and the company raising funds (the issuer) and commit the investment amount through the Payment Gateway. You are then given a cooling off period of six business days, whereby you may withdraw the full amount of the committed investment.

- End of Fundraising: You can commit an amount to invest in the business by clicking on the ‘INVEST’ button. This will prompt for you to complete your personal information and declare your capacity to invest (see investor elibility: Sophisticated/Angel/Retail). Agree with the proposed Investment Agreement set between you and the company raising funds (the issuer) and commit the investment amount through the Payment Gateway. You are then given a cooling off period of six business days, whereby you may withdraw the full amount of the committed investment.

How much will it cost?

Signing up as a member is free.

Once you become a member, you can enjoy free access to all deals and make investment(s) with no additional cost or fees. However, please take note that all required government levies or taxes will be charged accordingly, when an investment is concluded. For example: stamp duty etc.

Is there a maximum or minimum investment amount?

This varies, depending on the type of investor that you fall under (see How much can I invest?) and the minimum requirement set by the listed businesses for funding.

How long does a business have to raise funds?

Entrepreneurs are given a maximum period of 90 days to list their business and reach their funding target. You can keep interesting deals under your own personalised ‘Watch List’ and track the deals’ funding progress.

What happens if the target funding amount is not reached?

If the minimum amount is not reached within the listing period, the funding round has not succeeded. In this case, the business will not get funded and you as an investor will get refunded the total amount committed.

All the committed funds are returned to investors.

What happens if the campaign I invested in is overfunded?

If an issuer reaches its minimum target raise (listed on the Deal Page as Target Funding) it may wish to raise further capital to, for example to achieve another milestone that costs more money, such as expediting plans to break into a new market. The issuer must have outlined from the outset what its maximum overfunding amount would be. This is reflected under The Offer term sheet section on the Deal Page where issuers will state the maximum offering size they intend to raise. The value of on an investment made prior to overfunding will remain the same, as the post-money valuation will go up by the amount invested. It is important to note that in the event of an overfunding, the issuer has the liberty to select investors who will be involved in closing the deal. This means that some investors may be left out from the deal, and the investment amount will be fully refunded to the investor who are not selected.

Will my shares get diluted in an overfunded campaign?

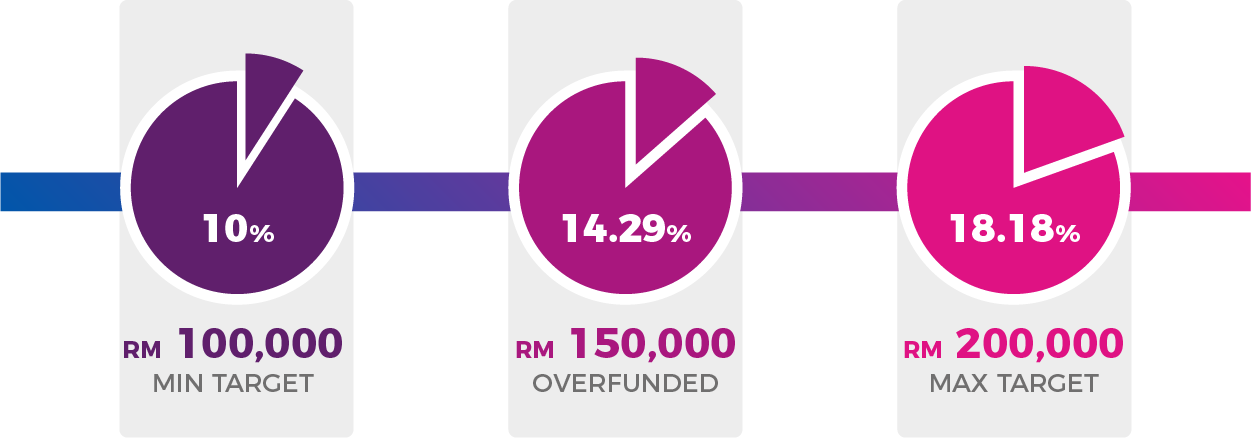

Once a pitch reaches its funding target it may choose to ‘overfund’, enabling the issuer to accept more investment in exchange for releasing more equity. Investments made during this time have the same rights as those made before. To illustrate how overfunding affects the equity available to the crowd, an issuer that initially offered 10% equity in exchange for an initial funding target of RM 100,000 will need to release more equity as follows:

How can I monitor and track the performance of my investments?

As a shareholder, you can communicate directly with your investee companies and request for a regular business progress update via the online Dashboard available on the ATA PLUS portal. While we don’t manage these communications, we do however provide assistance and tools that facilitate and encourage ongoing flows of information to investors. See Closed-User-Group Listing online Forum.

Completing an Investment

How do I make payments for my committed investment?

You can make payment via online direct debit or credit card facilities available on our platform. For telegraphic transfers or other modes of payment, you can select the option available on the payment window, or, contact us via email at [email protected]. Please state your ATA PLUS username account, the name of the pitch that you want to invest in, the amount that you want to invest in and the preferred mode of payment. A member of our team will then contact you directly to facilitate the payment.

How do I cancel my committed investment before the funding round closes?

You are allowed to forfeit from a committed investment within 6 business days (cooling-off period) starting from the date of payment. You can do so by emailing us at [email protected]. Please state your ATA PLUS username account, the name of the pitch that you had committed to and the amount you wish to cancel. A member of our team will then process this for you and send you a written confirmation of the cancellation.

Can I ask entrepreneurs more questions about their business?

By all means, please do! You can engage with the entrepreneurs during the funding round by participating in the online forum designed for all potential investors to communicate with the entrepreneur. You can also use the forum to discuss the offer with other investors and help each other to form opinions on the business’s prospects.

In addition, you can always request a copy of the business plan from the entrepreneur.

When will I get a return and how can I exit from the investment?

You can realise your investment returns in two ways:

- When a company chose to distribute profits to shareholders in the form of a dividend

- When you sell your shares for a higher value than when they were purchased. This can happen through:

- Trade/sale through a secondary market (if and when secondary markets for these shares develop in Malaysia

- The company you invested in decides to buy back shares from investors

- The company you invested in is acquired/purchased

- The company you invested in decides to go for public listing

You should be informed that there is no guarantee that you will be able to sell your shares when you want to, or at all. Therefore the timing and nature of your return is uncertain.

Who will coordinate the legal documentation?

ATA PLUS will provide a standard form of shareholders/investment agreement for use. We will also extend the services of our legal advisors who can administer the entire transaction and documentation, at a very competitive rate.

However, the entrepreneurs and the investors may engage other legal advisors of their choice, if they wish to do so.

Couldn't find the answer?

Write to us, and we’ll get back to you with what you need to start investing!

ASK US